Find a mortgage that fits yourself

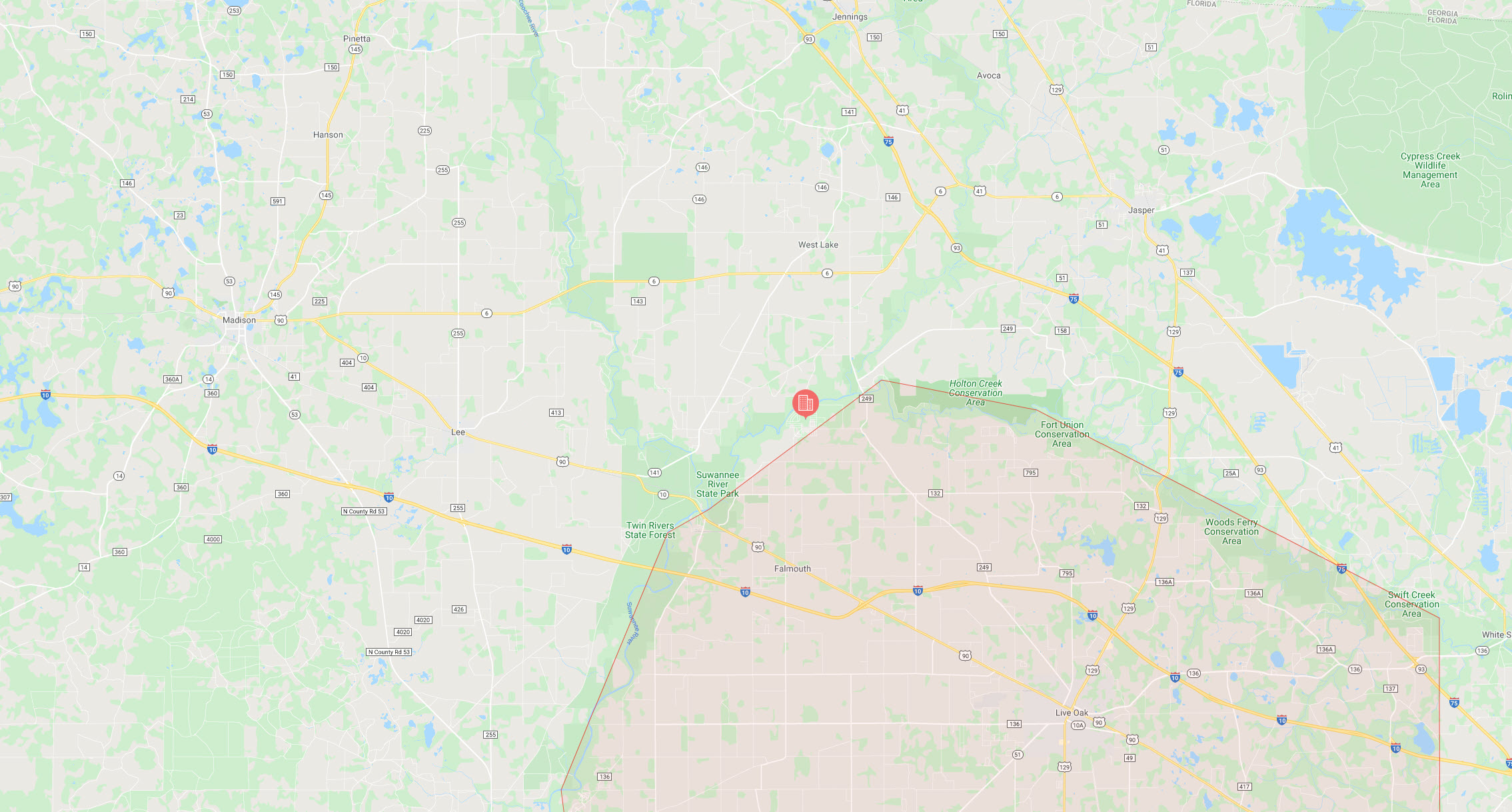

The newest USDA financing was good $0 down-payment, 100% money home mortgage choice offered to homeowners trying to find the dream domestic in the rural and residential district components. Don’t let their identity deceive you, this option could be for everyone interested in property additional away from a downtown key otherwise major city town. Actually, 97% out-of You.S. residential property size is approved to have USDA* money. Which is short for 109 billion some body, and on the you to definitely-third of the U.S. populace. It is extremely likely that a property in your area qualifies.

Exactly how USDA Fund Functions

This new USDA thinks bringing reasonable homeownership options encourages success, which often brings thriving teams and you can boosts the quality of life into the rural portion. With her, PRM therefore the USDA intentionally bring low-to-reasonable earnings house a way to get to the think of homeownership for the qualified outlying and you may suburban components.

To accomplish this, the fresh new USDA claims USDA finance against standard to ensure we are able to provide you with outstanding benefits, for example $0 deposit, low interest rates, and you may easy borrowing criteria.

USDA loans enjoys book guidelines and requires that are top managed of the a loan provider that have each other feel plus welfare at cardio. We are going to handle many techniques from pre-acceptance so you can closing. USDA commonly put the latest stamp out of acceptance into financing, and we’ll show you through the other individuals.

Qualifying to own an effective USDA Loan

Being qualified getting a great USDA financing is a lot easier than for a number of other loan brands given that mortgage doesn’t require a down payment otherwise a premier credit score. At the very least, the USDA need:

- You.S. citizenship otherwise long lasting residency

- Dependable income, normally a few successive ages

- The feeling and you may willingness to repay the loan fundamentally zero late payments or choices 1 year till the application

- An acceptable loans ratio, which can differ by financial or other issues

- This new homebuyer don’t generate over 115% of one’s area average earnings.

That enjoyable region in the USDA fund is the fact that customer and you can the home need both meet the requirements. That isn’t hard to do. Almost all of the land in the usa qualify getting an effective USDA loan and many short metropolises and suburbs away from urban centers fall within these criteria.

On the other hand, USDA financing are for sale to the acquisition of just one-house that’s an initial house. Property which have acreage is qualified, if your possessions dimensions are typical to your urban area rather than probably going to be used for money-creating motives, including farming. Income-producing assets and travel home do not qualify.

If you want to payday loan Florence know if you otherwise a property you happen to be trying to find qualifies to the USDA mortgage program, complete the shape below or contact us! We’re delighted to be their help guide to homeownership of pre-approval in order to closure!

All you have to Understand

- If you’d like to create, buy or reerica, an effective USDA financial is an excellent alternative that really needs 0% down

- To help you qualify for a USDA family, you will want to fulfill domestic venue, earnings and you will credit rating eligibility requirements

- A startling set of property qualify to have good USDA mortgage as long as your house is the number 1 quarters

Content

Based on present Census research, 86% of U.S. citizens inhabit location components. One to renders fourteen% of society spread out about outlying aspects of new nation hence covers 72% of state’s house city.

Thus, if you are searching for lots more room, there was lots of it to possess homebuyers who would like to go on to America’s rural parts.

Now, outlying does not always mean you need to go on a farm or even be the only house having kilometers to.

leave your comment